No, the main difference is that Earnings Before Interest and Tax includes all revenues and expenses except interest expenses and income taxes, while Operating Income only includes revenues and expenses related to primary business operations.

✦ EBIT considers non-operating income and expenses, while operating income does not

✦ EBIT provides a comprehensive measure of profitability, including core business operations and non-operating activities

✦ but if you want to measure the main business profitability, you should

prefer Operating Income

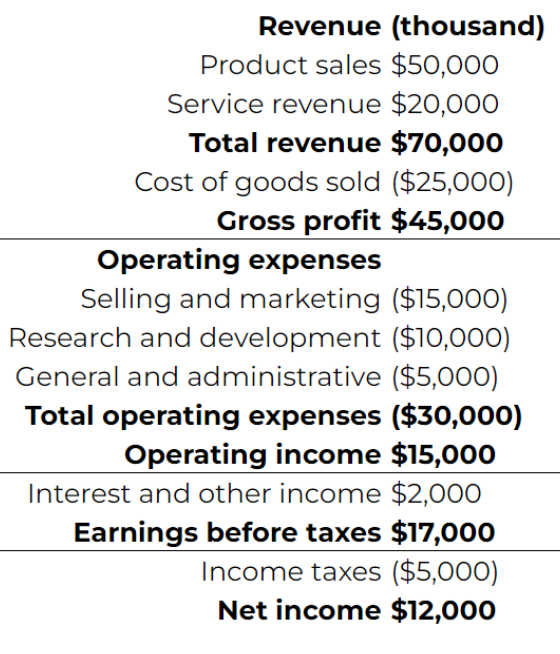

Let’s see an example of when EBIT is really equal to Operating Income in the P&L statement of a multinational technology company

In this example, no revenue earned or expense incurred that are listed before Operating income are non-operating, so it is equal to EBIT

If $2k of those $5k of general and administrative expense had been incurred for, let’s say, the sale of a non-business related property, EBIT would still be equal to $15k, while Operating Income would be equal to $17k

Check out our

Advanced Guide in reading Profit and Loss statement

→ Read it FOR FREE on Kindle Unlimited, CLICK HERE

Comments